Low income living can be pretty challenging, especially if you are looking for ways to save money on a tight budget. But with a little bit of creativity and planning, you can learn how to budget money and be happy with a low-income living.

Whatever your financial goals are, to pay off the mortgage on your home, paying off a debt, or just begin investing, you need to create a budget. You cannot just keep spending money as it comes.

Even with a low income of say $ 500 per month, you can successfully budget and improve your financial position. Make sure that the entire family is in while creating the budget.

In addition, see that you get out of debt first before you start making a budget. There are many ways for how to get out of debt on a low income.

Tip: For one, you can start hustling and look out for ways to earn more money on the side with side gigs.

8 Ways to Successfully Budget Your Money on a Low Income

#1. Tracking Spending

How to make a budget? Before you prepare a budget, track your spending for a few months. Keep all receipts to know where you are spending. You can make use of tracking software and then learn areas where you can start making cuts.

Tip1: Actually, you don’t have to manually track down every burger you have. Just use a single debit card or credit card. The technology will take care of the tracking.

Tip 2: Use credit cards for necessities and a debit card for entertainment, travel and other areas where you tend to spend more than necessary.

Must Read – How to Use a Credit Card Responsibly – Tips and Advice

#2. How to Make a Budget Plan? Make it a Family Affair

Make sure that you and your spouse shares the same financial goals. Involve your children as well. They may be into expensive soccer or music lessons. Tell them exactly how much such activities cost and the amount that you are ready to allocate for these. Decide which activity stays and which needs to go.

#3. Making a Sufficient Budget

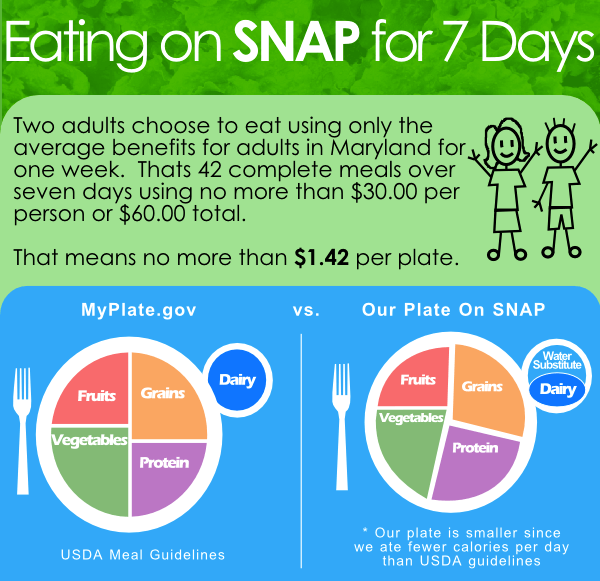

How to create a budget plan? Some bills are related to utilities, housing, food and transportation that you just cannot avoid. While trying to budget your money, make sure that there is enough money allocated for these expenses. Otherwise, you will only end up using the money placed for other items.

While looking for budget help, you can cut down the money allocated for unpredictable items, like a vacation; gifts; home improvements and so on. Use online budgeting tools like Mint as a budget manager to create your budget.

#4. Trimming and Cutting

As part of budgeting tips for low income families, try eliminating some of those fancy luxuries in your life. For instance, if you find that you have a fancy plan for your cell phone, you can change it.

Do you often buy takeaway food? When planning a low income budget, why not bring in your lunch from home. Are you making unwanted gym membership payments or cable payments that you don’t even use?

You could easily do without that morning latte while living on a budget. Keep housing costs low, at around 25% of the take home amount or even less. These are important aspects of budget guidelines.

But while creating a budget plan, don’t deprive yourself of every little enjoyment in life or you will lose the motivation in no time at all. You don’t have to nix everything that you enjoy. Just go for more affordable options.

#5. Creating Funds for Emergencies

You need a small cushion of savings to fall back in an emergency, as part of living on a low income tips. This could be anywhere around 3 to 6 months of expenses. For instance, you could face an unexpected car repair. Or, God forbid, you could lose your job.

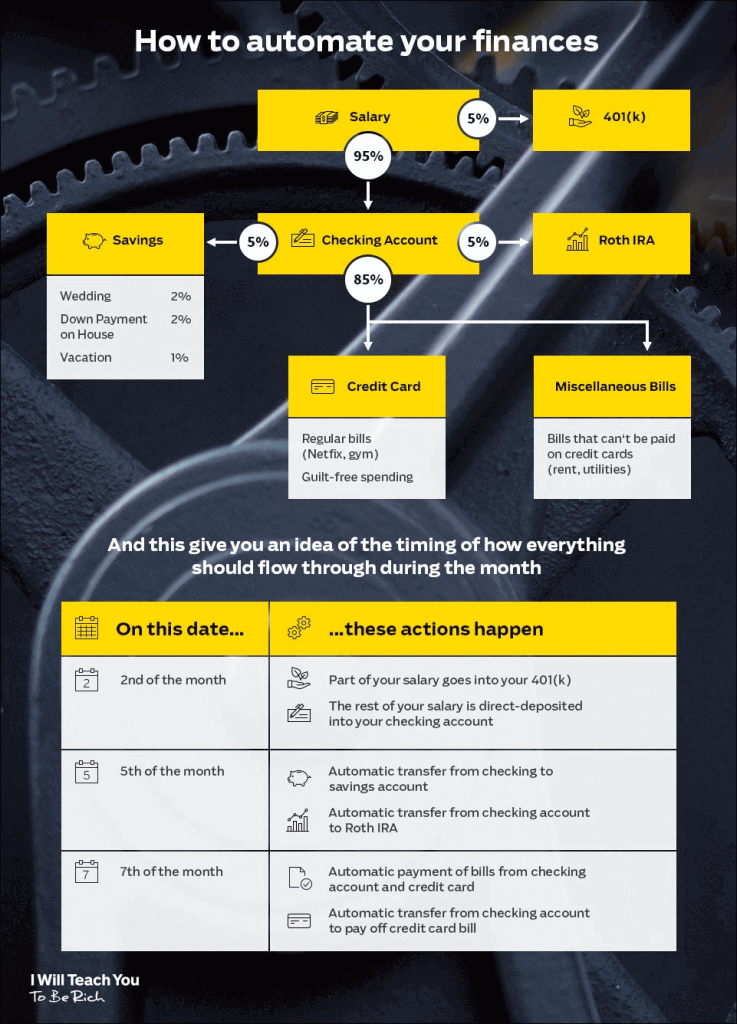

Decide how much you want to save and then use automatic transfer of your money to the emergency savings account.

#6. Frugal Practices – Best Way to Budget Money

Be frugal but don’t let it become so frustrating. This is just like dieting. If you strain too much, you’ll only end up cheating.

- Cut cable and other services that you don’t really use, as part of living on a low income tips.

- Negotiate for lower rates.

- Make adjustments to reduce electricity bills.

- Go for picnics in the local park, the beach, and other free events.

- Don’t buy on a whim and try to get money back while shopping by using Ebates.

- Go in for used clothing, cars, electronics. Ebay is great for getting some killer deals.

#7. Zero Sum Budget

If you want to live rich on a small income, give each dollar of your income a job, so that you don’t waste a single dollar of your income. The goal of a zero sum budget is to reach zero at the end of the month. But this only works if you have a good savings cushion.

Your income minus your expenditure must be equal to zero. If you find that you have $400 left at the end of the month, tell it where to go. It could be to pay off a debt, for investing, emergency savings etc.

Also Read – 12 Powerful Ways to Get Your Financial Life in Order

#8. Automated Savings

If you’re looking for a low income budget planner, make sure that you automate savings like paying into 401k, investments and so on. You may have the best of intentions, but sometime you find that you don’t have enough left over for savings after paying your bills.

Link your checking account with your savings account. Make sure that the designated part of the paycheck is automatically deposited in your savings account directly. If you’re paid on a weekly basis, make sure that the money is automatically transferred into the savings account.

Tip: The most challenging aspect is that you should not touch this money, unless there is an emergency.

Last Word

It can be extremely difficult to live on a small income and also create emergency funds, retirement funds etc. The first step you should be taking is to get control over your debts. Calculate your living costs using a budget planner.

This will give you a clear picture of your position, your earnings, spending and what you can save. In addition, you will learn whether you are able to live within your means and where you need to make cuts and trims in your lifestyle.

You can even try to increase your income and then control the amount that goes out. All this will put you in charge of your money, instead of allowing the money to control you. Now that you get that, you can confidently take your first step towards achieving your financial goals.

Source link